Did you know that over 4.4 million notaries in the United States are required by law to have a notary bond? This bond acts as a safeguard, ensuring notaries fulfill their ethical duties and providing financial compensation for any errors made.

Grasping the ins and outs of notary bonds can be a game changer for your career, helping you enhance credibility and avoid legal pitfalls. Ready to explore the essential aspects that will protect your professional integrity and streamline your bond management? Let's get started.

A notary bond is a type of surety bond that notaries are required to obtain to safeguard the public from errors or misconduct during notarization. This bond acts as a financial guarantee that the notary will perform their duties ethically and in accordance with the law. If a notary accidentally or intentionally causes harm through improper actions, the bond provides a source of compensation for the injured party.

Legally, a notary bond holds significant importance. It provides assurance that there's a financial recourse available if a notary fails to comply with the legal standards of their role. This bond isn't insurance for the notary but rather a protective measure for the public. The bond company can seek reimbursement from the notary for any claims paid out, ensuring accountability.

For you, as a notary, having a bond offers a layer of credibility and trustworthiness. It reassures the public that you're backed by a financial guarantee in case of any errors. Similarly, the public benefits from knowing there's a safety net in place, providing peace of mind when engaging in notarization processes. This mutual benefit strengthens the integrity of notarial services.

Notary bonds are important because they provide an essential layer of protection for the public and guarantee that notaries adhere to legal and ethical standards. When you become a notary, you assume a significant responsibility to act with integrity and accuracy. The bond ensures that if you make a mistake or engage in misconduct, the public is financially protected.

The bond serves as a financial guarantee that you'll fulfill your duties correctly. If you fail to do so, an injured party can make a claim against your bond, ensuring they're compensated for any losses. This protection is significant because it builds trust in the notary system, reassuring the public that they're safeguarded from possible errors or fraud.

Additionally, the bond underscores your accountability. Knowing that your actions are backed by a financial guarantee encourages you to stay diligent and compliant with state laws. This sense of responsibility is crucial, given that notarial errors can lead to significant legal and financial consequences.

Securing a notary bond involves several straightforward steps to guarantee you meet all legal requirements and protect the public effectively.

First, verify your eligibility to become a notary in your state, since requirements can vary. Generally, you need to be at least 18 years old, a legal resident of your state, and free of felony convictions.

Next, gather the necessary documentation. You'll typically need proof of your identity, residency, and any completed notary training or certification. Submit these documents along with your notary application to the appropriate state authority.

Once your application is approved, you'll need to purchase a notary bond. Look for reputable sources like insurance companies or bonding agencies. Many states provide a list of approved bond providers. When selecting a provider, consider their reputation, customer service, and bond coverage limits.

After purchasing the bond, submit proof of your bond to the state authority. This step finalizes your notary commission and ensures compliance with state regulations.

Understanding the costs associated with notary bonds is important for budgeting and ensuring compliance with state requirements. On average, you can expect these bonds to range from $50 to $150 for a four-year term. However, various factors influence this cost.

State regulations play a significant role; some states mandate higher bond amounts, which can increase the premium you pay. Moreover, the bond amount itself, typically ranging from $5,000 to $15,000, directly affects the cost.

Here’s a handy table outlining the average bond costs and amounts, courtesy of SuretyBondsDirect

| State | Cost | Term | Bond Amount |

| Alabama | $100 | 4 Year Term | $50,000 |

| Alaska | $40 | 4 Year Term | $2,500 |

| Arizona | $35 | 4 Year Term | $5,000 |

| Arkansas | $50 | 10 Year Term | $7,500 |

| California | $50 | 4 Year Term | $15,000 |

| District of Columbia | $50 | 5 Year Term | $2,000 |

| Florida | $99 | 4 Year Term | $7,500 |

| Hawaii | $50 | 4 Year Term | $1,000 |

| Idaho | $50 | 6 Year Term | $10,000 |

| Illinois | $30 | 4 Year Term | $5,000 |

| Indiana | $50 | 8 Year Term | $25,000 |

| Kansas | $35 | 4 Year Term | $12,000 |

| Kentucky | $40 | 4 Year Term | $1,000 |

| Louisiana | $110 | 5 Year Term | $10,000 |

| Michigan | $30 | 6 Year Term | $10,000 |

| Mississippi | $40 | 4 Year Term | $5,000 |

| Missouri | $40 | 4 Year Term | $10,000 |

| Montana | $45 | 4 Year Term | $25,000 |

| Nebraska | $40 | 4 Year Term | $15,000 |

| Nevada | $35 | 4 Year Term | $10,000 |

| New Mexico | $65 | 4 Year Term | $10,000 |

| North Dakota | $60 | 4 Year Term | $7,500 |

| Oklahoma | $25 | 4 Year Term | $1,000 |

| Pennsylvania | $60 | 4 Year Term | $10,000 |

| South Dakota | $50 | 6 Year Term | $5,000 |

| Tennessee | $30 | 4 Year Term | $10,000 |

| Texas | $50 | 4 Year Term | $10,000 |

| Utah | $50 | 4 Year Term | $5,000 |

| Washington | $40 | 4 Year Term | $10,000 |

| West Virginia | $50 | 5 Year Term | $1,000 |

| Wisconsin | $25 | 4 Year Term | $500 |

| Wyoming | $60 | 4 Year Term | $500 |

Comparing costs between different providers is vital. While one company might offer a bond at the lower end of the spectrum, another could charge considerably more for the same coverage. It's essential to research and compare multiple providers to make sure you're getting the best rate without compromising on the required coverage.

For a detailed insight into notary costs as a customer, you can visit our post on how much does it costs to get something notarized.

When considering notary bonds, you'll encounter two primary types: standard notary bonds and Errors and Omissions (E&O) insurance.

When you obtain a standard notary bond, a surety company backs you, promising to cover any financial losses incurred by your clients due to negligence or misconduct. Should a claim arise, the surety company pays the claim up to the bond amount, and you, the notary, are responsible for reimbursing the surety company.

Standard notary bonds typically range from $5,000 to $15,000, depending on state requirements. They're important for safeguarding public trust, ensuring that notaries adhere to legal and ethical standards. By securing a standard notary bond, you demonstrate a commitment to professional integrity, which reassures your clients that their documents are in safe hands.

While standard notary bonds provide essential protection, they don't cover all potential liabilities, highlighting the importance of exploring additional safeguards.

Beyond the protection offered by standard notary bonds, Errors and Omissions (E&O) insurance provides an additional layer of security for notaries public, covering liabilities that bonds don't typically address.

While standard notary bonds protect the public from financial loss due to a notary's misconduct or negligence, E&O insurance shields you from the financial repercussions of unintentional mistakes and oversights in your notarial duties.

E&O insurance covers legal fees, settlements, and other costs associated with claims of errors or omissions. This is critical because even the most diligent notaries can make inadvertent errors, such as incorrect documentation or failure to authenticate a signature properly. These mistakes can lead to costly lawsuits and damage your professional reputation.

When considering E&O insurance, think about the complexity and volume of the documents you handle. If your notarial work involves high-stakes transactions or intricate legal paperwork, E&O insurance is highly advisable. It's also wise to evaluate your risk tolerance and financial stability. Investing in E&O insurance can offer peace of mind and protect your personal assets.

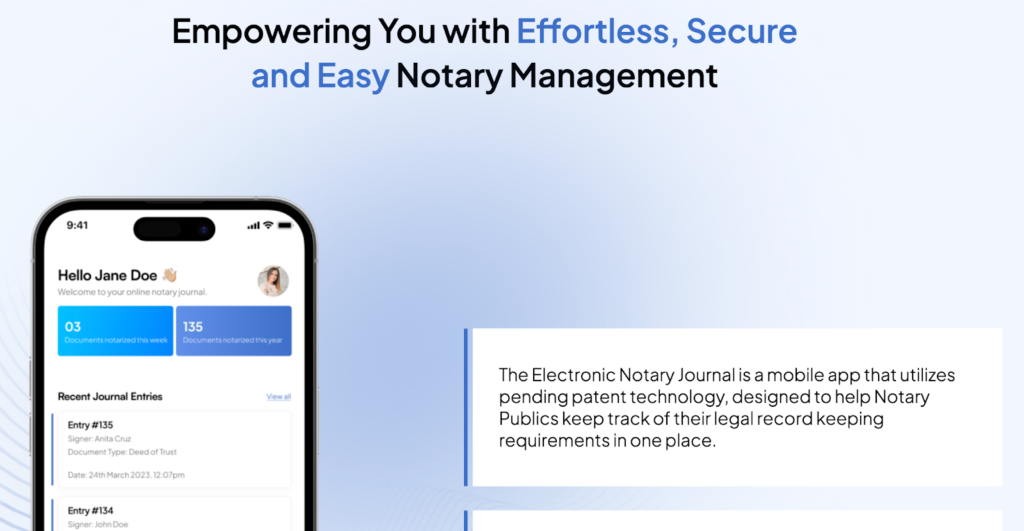

Incorporating E&O insurance with tools like the Electronic Notary Journal app enhances your notarial practice by ensuring thorough protection and efficient record-keeping.

Understanding state-specific requirements for notary bonds is essential for compliance. Each state has unique regulations regarding bond amounts, renewal periods, and application processes.

Each state in the U.S. has specific requirements for notary bonds that notaries must abide by in order to guarantee compliance and protection. For instance, California mandates a minimum bond amount of $15,000 for a four-year term. This guarantees that notaries have adequate coverage to protect the public from potential errors or misconduct.

In Texas, the requirements are a bit different. Notaries must obtain a $10,000 bond, but there are specific conditions and exceptions. For example, attorneys and certain government officers may be exempt from this requirement. Having a good grasp of these nuances is essential for compliance.

Florida notaries face another set of rules. They must secure a $7,500 bond and adhere to specific compliance and renewal procedures. The bond must be renewed every four years, aligning with the notary commission term. The renewal process involves submitting a new bond application and ensuring ongoing compliance with state regulations.

Navigating these varied requirements can be complex, but it's vital for ensuring your notary practice is legally sound. Utilizing tools like the Notary Journal App can streamline compliance by securely storing all necessary information and simplifying record-keeping. For more information, check out Can You Be a Notary in Multiple States?.

Maintaining your notary bond up to date is essential for preserving your status as a legally compliant Notary Public. A lapsed bond can result in penalties, loss of your notary commission, and legal consequences. To avoid these issues, it's important to renew your bond before it expires.

Start by checking the expiration date on your current bond. Most bonds are valid for four years, but this can vary by state.

Set a reminder at least two months before the expiration date to start the renewal process. Contact your bonding company to begin the paperwork. They might require updated information or additional documents, so have everything ready in advance. Once approved, make sure the new bond is filed with the appropriate state authority.

Failing to renew on time can lead to interruptions in your notary services. You might even need to reapply for a new commission, which can be a lengthy and costly process.

To keep track of renewal dates, consider using tools like the Electronic Notary Journal app, which can store your bond information and send timely reminders, making sure you never miss an important deadline.

Acquiring knowledge about the differences between notary bonds and notary insurance can greatly impact your professional safeguarding and financial protection as a Notary Public.

Notary bonds serve as a guarantee to the public that you'll perform your duties ethically and legally. If you make an error or engage in misconduct, the bond provides compensation to the harmed party. However, you're still responsible for repaying the bond amount to the surety company, effectively making it a loan.

On the other hand, notary insurance protects you directly. Also known as Errors and Omissions (E&O) insurance, it covers legal fees and settlements arising from mistakes or unintentional acts committed during notarizations. Unlike a bond, insurance doesn't require repayment to the insurer, offering you financial relief in the event of a claim.

Opting for both notary bond and insurance is often a wise decision. While the bond meets legal requirements and protects the public, the insurance safeguards your personal assets and finances. By balancing both, you ensure thorough coverage, maintaining trust and reliability in your professional services.

This dual protection enhances your peace of mind and fortifies your notary practice against potential pitfalls.

It usually spans four years, aligning with the term of your notary commission. Always check your state's regulations since durations can vary, ensuring you stay compliant.

No, you can't transfer a notary bond to another state. Each state has its own requirements and regulations, so you'll need to obtain a new bond specific to the state where you plan to practice.

When a notary bond claim is filed against you, the bond company investigates the claim. If the claim is validated, the company compensates the claimant up to the bond amount, and you'll be required to reimburse the bond company.

Yes, notary bonds can be tax-deductible expenses if they are required for your business operations. Be sure to consult with a tax professional to confirm you're accurately applying deductions according to the latest tax laws.

Ever wonder how a notary bond differs from a surety bond? A notary bond protects the public from notary misconduct, while a surety bond guarantees a party fulfills their obligations. Both provide essential safeguards but serve distinct purposes.

Obtaining and maintaining a notary bond is essential for ensuring that you fulfill your duties responsibly and ethically. This bond not only protects the public but also provides financial security and peace of mind for the notary. By understanding the requirements and processes involved, notaries can ensure they remain compliant with state regulations and provide trustworthy services.

Using tools like the Notary Journal App can greatly enhance the management of your notary bonds. The app helps keep track of renewals, maintain records, and ensure that all necessary compliance measures are met. Embrace the efficiency and security offered by the Notary Journal App to streamline your notarial duties and uphold the highest standards of professionalism. Download and use the Notary Journal App today to manage all your notarial needs effectively.